20+ Bridge loan mortgage

This advertisement is not an offer to lend and does not empower you to accept any loan agreement. The reason for high interest rates on bridge loans is because the lender knows you will only have the loan for a short time.

6 Best Things To Do In Wilmington N C Trips To Discover Travel Photography Europe Trip England Beaches

The average student loan debt is around 30000 according to US.

. Zip code Purchase Price 30 Years Fixed 25 Years Fixed 20 Years Fixed 15 Years Fixed 10 Years Fixed 7 Year ARM 5 Year ARM 10 Year ARM Loan Type. Halley Spencer and the team did a excellent job on our bridge loan and purchase of our new home. Under the terms of an 80-10-10 loan you pay 10 down then obtain two mortgages.

The gov means its official. You can also use a bridge loan to present an offer without a financing contingency when you make an offer to purchase a home. 85 - Owner-Occupied 75 - Investment.

If you set up auto-pay for your personal loan car loan mortgage or other kind of loan. The experiments randomly varied the prevalence of weak ties in the networks of over 20 million people over a 5-year period during which 2 billion new ties and 600000 new jobs were created. I have multiple lenders that I have used in the past 20 years being a agent.

As Houston Luxury Properties owner I will be using Halley and the team on all my future buyers. Before sharing sensitive information make sure youre on a federal government site. Keep your credit utilization ratio below 20 and check your credit report for any errors.

Wilshire Quinn Is A Direct Private Money Lender Financing Bridge Loans In 5 To 7 Days From 200000 To 10000000. However depending on the lender some may. Once the bridge loan closes youll start paying it back in addition to your actual mortgage.

As for down payment lenders may require you to make a 20 percent to 30 percent down payment. If you do not put down 20 percent PMI is required and raises your mortgage payments. The short-term interest-only loan is usually at a prime-plus rate while the later portion reflects regular mortgage interest rates.

A bridge loan may not make sense if you dont have more than 20 equity. Specializing In Purchase Refinance Cash-Out And Rehab Loans In California And Nationwide. When used for real estate a bridge loan requires a borrower to pledge their current home or other assets as collateral to secure the debtplus the borrower must have at least 20 equity in.

350000 current value X 80 80 of value _____ 280000 first-mortgage bridge loan. For example you might use it to cover closing costs for a new mortgage. 6504 Bridge Point Parkway Suite 500 Austin TX 78730 Kasasa Products.

In order to qualify businesses must satisfy SBAs definition of a small business concern along with the size standards for small business. One for 80 of the new homes asking price and a second for the remaining 10. Mortgage First terms and conditions may change without notice.

Todays commercial loan rates can average between 450 and 1648 depending on the loan product. Since youre effectively putting 20 down there is no PMI. Certain government programs such as SBA loan programs and contracting opportunities are reserved for small businesses.

On a 250000 loan that has a 3 interest rate you might be paying 1054 for a conventional loan an amount that would rise to 1342 with a bridge loan that had a 2 higher interest rate. First-mortgage bridge loan Second-mortgage bridge loan. This is similar to traditional commercial loans.

Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. What is a small business size standard. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

The first mortgage is typically a conventional loan via Fannie Mae or Freddie Mac and its offered at current market mortgage rates. A CMBSConduit mortgage is a non-recourse loan provided by a financial institution that securitizes the loans after closing by pooling the loans together. Real-time accurate rates and closing costs for a variety of loan programs custom to your specific situation.

An 80-10-10 loan provides a vehicle through which to buy a new home with less than a 20 down payment while also avoiding additional fees due to private mortgage insurance. 30-year fixed-rate mortgage USDA loan conventional loan FHA I CAN mortgage allows you to customize your loan terms from 8 to 30 years Buydown loan allows you to reduce your mortgage. Earning a college degree is seen as a key component of the American dream but that achievement often comes at a steep cost.

A mortgage in itself is not a debt it is the lenders security for a debt. The results provided experimental causal evidence supporting the strength of weak ties and suggested three revisions to the theory. LTV definition and examples March 17 2022 2022 VA Loan Residual Income Guidelines For All 50 States And The District Of Columbia January 2 2020.

I Googled bridge loans and Halley answered and got us done. Loan-to-value ratio for mortgage. A financing contingency is a contract clause that allows a buyer to get back money put down without penalty in the case the buyer cannot secure.

With an 80-10-10 loan you put down 10 percent and finance two mortgagesthe first mortgage for 80 percent of the purchase price and the remaining 10 percent is a second loan. No loan will issue without buyers provision of insurance an adequate appraisal and clear title. Depending on the lenders terms.

Home equity lines have a 10year draw period followed by a 20year repayment. The loan is secured on the borrowers property through a process. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan.

Bridge Loan. You can avoid private mortgage insurance PMI by putting down 20 percent or more of your down payment. Can be hard to qualify for if your.

This requires you to take out an interest-only loan for construction and then refinance into a regular mortgage when the house is completed. Federal government websites often end in gov or mil. You may have options for how you make your monthly payment.

Some lenders however prefer a less risky two-step process.

Ex 99 1

Second Mortgages Mezzanine Financing For Commercial Real Estate

We Have A Long List Of Buyers Searching In Carroll County That We Are Constantly Building On In 2022 Selling Your House Property Valuation Outdoor

Covid 19 Resources Wood County Economic Development

Tyler Murray Lt Murray Twitter

Tpg Re Finance Trust Inc 2021 Current Report 8 K

Hes Lending Platform Pricing Alternatives More 2022 Capterra

Ex 99 1

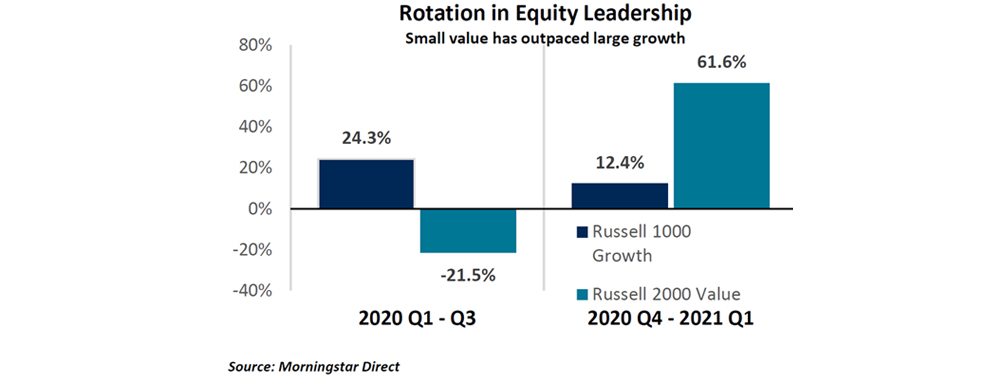

First Quarter 2021 Recap

Ex 99 1

Reits Vs Real Estate Mutual Funds What S The Difference

Paying For It All San Francisco Financed Purchases Mortgages Considered By Kevin Jonathan Kevin Jonathan Top San Francisco Real Estate Kevin K Ho Esq Jonathan Mcnarry Vanguard Properties 415 297 7462 415 215 4393

How To Get A Bridge Loan Pacific Private Money

Ex 99 1

Bridge Loan How Bridge Loan Works With Example And Explanation

2

Qiz J1p7cu1cm